Risultati della ricerca

Tutte le categorie

Cancella

Cerca

Applica

Cerca in

Categoria

Ripristina

Filtra per

precedente

Avanti

Guide

Disconnettersi

Dashboard account

Seleziona la tua lingua

VIDEO

https://learning.squarespace.com

WEBINAR

https://forum.squarespace.com

FORUM

/hc/requests/new#choose-topic

Contattaci

CHAT LIVE: CHIUSA

CHAT LIVE: APERTA

Login

Visualizza tutti i risultati

Invia

Scegli un argomento

Potrebbe essere utile:

Hai ancora bisogno di contattarci?

Conversazioni in tempo reale e risposte immediate.

Chat Live

Dal lunedì al venerdì:

dalle 4:00 alle 20:00 EST

Inviaci un messaggio e leggi le nostre risposte quando preferisci.

Email

Contattaci via e-mail per ricevere aiuto con questo argomento.

24 ore al giorno

7 giorni la settimana

Accedi a Squarespace

Torna indietro

Questa guida non è ancora stata tradotta in italiano. Sarai reindirizzato alla versione inglese fra 5 secondi.

Attualmente offriamo supporto chat live solo in inglese.

ASSISTENZA VIA E-MAIL IN ITALIANO

CHAT IN INGLESE

Supporto Squarespace 5

Per domande sulla piattaforma legacy Squarespace 5, visita il Centro di Assistenza:

Indietro

Recupera l'accesso al tuo account o sito

Se hai provato a

recuperare il tuo account Squarespace o Acuity e non riesci ancora ad accedervi, siamo qui per aiutarti. Inserisci quante più informazioni puoi, ma se non hai la certezza di dettagli specifici, inserisci l'ipotesi migliore.

Prima di iniziare:

• Hai già provato a recuperare il tuo account tramite la pagina di login? Ti consigliamo di provare se non l'hai ancora fatto.

• Per la tua sicurezza, forniremo informazioni solo al titolare dell'account.

• Per assistenza nel recupero di un account Google Workspace, puoi contattarci qui.

L'indirizzo e-mail dove possiamo contattarti.

Quale situazione ha portato alla difficoltà di accesso al tuo account?

URL di qualsiasi website collegato all'account. Inserisci quanti più domini possibile.

Allega entrambi i seguenti documenti:

• Un documento d'identità rilasciato dallo Stato. Ad esempio, una patente di guida, un passaporto o un certificato di residenza permanente.

• Un estratto conto bancario che riporti l'intestazione della banca, il nome del titolare del conto bancario e l'addebito più recente di Squarespace. Puoi tranquillamente occultare le altre informazioni personali contenute nel documento. (Non richiesto per problemi con l'autenticazione a due fattori.)

Nota:

• Se hai inserito più siti Web qui sopra, allega gli estratti conto che mostrano l'addebito più recente associato a ogni sito.

• Accertati che i tuoi file siano .jpg o .png in modo che possiamo visualizzarli.

Richiedi l'accesso all'account

Segui questi step:

Maggiori informazioni

Richiedi un rimborso

Ricevi nostre notizie entro 2 giorni lavorativi.

Se disponi di un certificato di esenzione fiscale, allegalo qui. Sono accettati i formati file .pdf, .png, .jpeg .

Utilizza questo modulo per inviare una richiesta di esenzione dall'imposta sulle vendite riscossa per i pagamenti Squarespace.

Inserisci qui i dettagli della tua richiesta. Se non risiedi in uno dei Paesi in cui riscuotiamo tale imposta e credi che essa non dovrebbe essere applicata ai tuoi acquisti, fornisci dei chiarimenti.

Se hai commenti sulle nostre modalità di riscossione dell'imposta sulle vendite, inviali qui.

Il tuo feedback aiuta a rendere Squarespace sempre migliore e noi esaminiamo ogni richiesta ricevuta. Considera che non possiamo rispondere individualmente, tuttavia ti contatteremo nel caso in cui avessimo bisogno di maggiori dettagli.

Commenti generali relativi all'imposta sulle vendite

Richiedi l'esenzione dall'imposta sulle vendite

Dicci di più

Carica uno screenshot del problema che stai riscontrando o del contenuto del sito che desideri modificare, così da permetterci di aiutarti in modo più rapido. Scopri come acquisire uno screenshot, qui:

https://sqsp.link/hMaBjwSquarespace rispetta i diritti di proprietà intellettuale e richiede che i suoi utenti si comportino allo stesso modo. Squarespace risponde tempestivamente alle denunce di violazione del copyright commesse utilizzando i Servizi.

Per inviare una segnalazione di presunta violazione del copyright, è necessario utilizzare il modulo sottostante.

Nei casi in cui Squarespace svolga solo il ruolo di Registrar e non fornisca servizi di web hosting, Squarespace non esercita alcun controllo sui contenuti e questi non risiedono sui server di Squarespace. Di conseguenza, per risolvere il problema della violazione del copyright, sarà necessario rivolgersi direttamente al proprietario del sito o al fornitore del servizio di web hosting.

In risposta alle segnalazioni su presunte violazioni del copyright, Squarespace può rimuovere o limitare l'accesso al materiale in questione. Si noti che le informazioni fornite in una comunicazione di violazione del copyright possono essere inoltrate all'utente che ha pubblicato il contenuto potenzialmente violato o al proprietario del sito.

Squarespace si impegna a fornire ai propri clienti un servizio sicuro e affidabile. Se ritieni che su Squarespace siano presenti contenuti illeciti, ti preghiamo di inviare una segnalazione di contenuto illecito a Squarespace utilizzando il modulo sottostante. Abbiamo introdotto questo canale di segnalazione per i clienti in conformità con l'articolo 16 del Digital Services Act dell'Unione Europea (Regolamento (UE) 2022/2065) ("DSA").

Segnalazione di malware

Squarespace Domains LLC e Squarespace Domains II LLC si impegnano a fornire un servizio sicuro e affidabile. Se hai dei dubbi su un nome di dominio registrato con Squarespace, puoi inviarci una segnalazione.

Il malware, o software dannoso, è un programma progettato per interrompere, danneggiare o ottenere l'accesso a un computer all'insaputa del proprietario. Il malware include virus, spyware, ransomware e altri software indesiderati. Il malware utilizzato da più fonti viene definito botnet.

Per ulteriori informazioni sulla segnalazione di altre attività di dominio sospette a Squarespace, visita

Segnalare eventuali abusi di un dominio.

Prima di iniziare:

• Assicurati che il dominio che stai segnalando sia

registrato e gestito tramite Squarespace.

Visita i nostri

Termini di Servizio e la nostra

Politica d'uso accettabile per consultare le nostre politiche in materia di abusi e attività fraudolente o illegali.

Segnalazione di phishing o pharming

Squarespace Domains LLC e Squarespace Domains II LLC si impegnano a fornire un servizio sicuro e affidabile. Se hai dei dubbi su un nome di dominio registrato con Squarespace, puoi inviarci una segnalazione.

Il phishing è un tipo di frode che tenta di indurre gli utenti a condividere informazioni sensibili come i dati della carta di credito, le password o i dettagli dell'account.

Mentre il phishing tenta di indurre gli utenti a condividere informazioni sensibili, il pharming mira a reindirizzare gli utenti a siti fraudolenti tramite DNS modificato/hackerato, invece di dove l'utente intendeva andare in origine.

Per ulteriori informazioni sulla segnalazione di altre attività di dominio sospette a Squarespace, visita

Segnalare eventuali abusi di un dominio.

Prima di iniziare:

• Assicurati che il dominio che stai segnalando sia

registrato e gestito tramite Squarespace.

Visita i nostri

Termini di Servizio e la nostra

Politica d'uso accettabile per consultare le nostre politiche in materia di abusi e attività fraudolente o illegali.

Segnalazione di spam

Squarespace Domains LLC e Squarespace Domains II LLC si impegnano a fornire un servizio sicuro e affidabile. Se hai dei dubbi su un nome di dominio registrato con Squarespace, puoi inviarci una segnalazione.

Lo spam comprende tutte le e-mail massive non richieste inviate senza il consenso del destinatario. Ciò include lo "spamvertising" e l'invio di e-mail che violano il

CAN-SPAM Act.

Per ulteriori informazioni sulla segnalazione di altre attività di dominio sospette a Squarespace, visita

Segnalare eventuali abusi di un dominio.

Prima di iniziare:

• Assicurati che il dominio che stai segnalando sia

registrato e gestito tramite Squarespace.

Visita i nostri

Termini di Servizio e la nostra

Politica d'uso accettabile per consultare le nostre politiche in materia di abusi e attività fraudolente o illegali.

Testo temporaneo

Segnalazione di imprecisioni WHOIS

Squarespace Domains LLC e Squarespace Domains II LLC si impegnano a fornire un servizio sicuro e affidabile. Se hai dei dubbi su un nome di dominio registrato con Squarespace, puoi inviarci una segnalazione.

I proprietari di domini sono tenuti a mantenere aggiornati i propri record WHOIS. Tramite questo modulo è possibile segnalare dati di contatto del dominio inesatti, obsoleti o intenzionalmente falsi.

Per ulteriori informazioni sulla segnalazione di altre attività di dominio sospette a Squarespace, visita

Segnalare eventuali abusi di un dominio.

Prima di iniziare:

• Assicurati che il dominio che stai segnalando sia

registrato e gestito tramite Squarespace.

Visita i nostri

Termini di Servizio e la nostra

Politica d'uso accettabile per consultare le nostre politiche in materia di abusi e attività fraudolente o illegali.

Squarespace rispetta i diritti di proprietà intellettuale e si aspetta che i suoi utenti facciano lo stesso. Squarespace risponde prontamente alle segnalazioni di violazioni di marchio commesse durante l'utilizzo dei servizi. Per inviare una notifica di presunta violazione del marchio, è necessario inviare una notifica di violazione utilizzando il modulo sottostante.

Si prega di notare che nei casi in cui Squarespace è solo il registrar e non fornisce servizi di hosting web, Squarespace non controlla il contenuto e il contenuto non risiede nei server di Squarespace; sarà necessario risolvere la presunta violazione del marchio direttamente con il proprietario del sito o il fornitore del servizio di hosting web.

La risposta di Squarespace alle notifiche di presunta violazione del marchio può includere la rimozione o la restrizione dell'accesso al materiale che presumibilmente costituisce violazione. Le informazioni fornite in una notifica di violazione del marchio possono essere inoltrate all'utente che ha pubblicato il contenuto che presumibilmente viola il marchio o al proprietario del sito.

Compila tutti i campi obbligatori.

#

#

Squarespace Scheduling è diventato ufficialmente Acuity Scheduling. Per ricevere assistenza nell'organizzazione degli appuntamenti, cerca "Acuity" o consulta le guide correlate nella sezione "Acuity Scheduling".

#

#

Utilizza questo modulo per inviare una richiesta riguardante il sito o l'account Acuity Scheduling di un cliente Squarespace defunto. Porgiamo le nostre più sentite condoglianze a te e alla tua famiglia in questo triste momento e apprezziamo la sua pazienza mentre elaboriamo la sua richiesta.

A causa di problemi relativi alla privacy e di restrizioni, purtroppo non possiamo fornirti il controllo amministrativo del sito. Tuttavia, se un parente stretto o un rappresentante legale compila il modulo sottostante, potremmo essere in grado di concedere le autorizzazioni di fatturazione in modo che il sito possa rimanere attivo o annullare eventuali abbonamenti attivi.

Considera che le autorizzazioni di fatturazione non includono la possibilità di modificare il contenuto del sito. Puoi trovare maggiori informazioni

qui.

Nota relativa ai siti Squarespace 5:

Squarespace 5, la nostra piattaforma legacy, non consente la modifica delle autorizzazioni. Tuttavia, possiamo cancellare o rimuovere il sito.

Una nota relativa agli account Acuity Scheduling:

Non è possibile concedere le autorizzazioni di fatturazione sugli account Acuity senza un accesso Squarespace. Tuttavia, possiamo cancellare o rimuovere l'account.

Invia una richiesta sull'account di un cliente deceduto

Subject

Any comments, requests, or concerns we should know?

Please attach the following documents:

• An image of your government-issued ID, such as a driver’s license, passport, military ID, or permanent resident card. This is for proof of your relationship to the deceased.

• An image of the deceased person’s obituary, death certificate, and/or other documents.

• Any additional documents, such as Legal Representation documentation.

Inviaci un messaggio. Gli orari di apertura sono dal lunedì al venerdì, dalle 5:30 alle 20:00 EST. I messaggi inviati al di fuori di questi orari riceveranno una risposta entro 12 ore.

Dal lunedì al venerdì:

dalle 4:00 alle 20:00 EST

Centro assistenza Squarespace

Trova risposte e risorse

Vedi altri risultati

Sfoglia per prodotto

Website

Aggiungere contenuto con blocchi

Formattare le immagini per la visualizzazione

Modificare i colori

Lista di controllo SEO

Domini

Collegare un dominio

Spostamento di un dominio in un altro sito

Migrazione di Google Domains su Squarespace

Trasferimento di un dominio

Commerce

Aggiungere prodotti al tuo negozio

Connettere un elaboratore di pagamento

Creazione di sconti

Impostazione delle imposte

Campagne Email

Creare mailing list

Creare profili mittente

Procedure consigliate per le campagne e-mail

Guida introduttiva alle Campagne e-mail di Squarespace

Google Workspace

Utilizzare Google Workspace con Squarespace

Aggiunta di altri utenti di Google Workspace

Registrazione a Google Workspace

Rinominare un utente Google Workspace

Acuity Scheduling

Aggiungere Acuity al proprio sito web

Iniziare un periodo di prova di Acuity Scheduling

Creare e modificare i tipi di appuntamento

FAQ su Acuity Scheduling

Centro assistenza Acuity

Che cos'è Acuity Scheduling?

Prezzi, fatturazione e fatture di Acuity Scheduling

Aree membri

Creare contenuti riservati

Personalizzazione dell'esperienza Aree membri

Gestione dei membri

Guida introduttiva alle aree membri

Guide per argomento

Mostra di più

Mostra meno

Introduzione

Tutto ciò di cui hai bisogno per iniziare e lanciare il tuo sito su Squarespace

Account

Analytics

Ricevi assistenza per le impostazioni dell'account, la password e i collaboratori del sito

Pagamenti

Visualizza i rapporti per ottenere informazioni dettagliate sul coinvolgimento dei visitatori e sulle vendite

Ricevi assistenza con i tuoi piani, pagamenti e abbonamenti

Commerce

Scopri come configurare, gestire e far crescere il tuo negozio online

Domini

Ricevi assistenza dettagliata per la registrazione, il trasferimento e la connessione di domini

Google Workspace ed e-mail personalizzate

Immagini e video

Imposta un indirizzo e-mail personalizzato con il tuo dominio

Fai risaltare il tuo sito con immagini, video e banner

Integrazioni ed estensioni

Aggiungi integrazioni di terze parti per aiutarti a gestire, ottimizzare ed espandere il tuo sito

Marketing

Diffondi la voce sulla tua attività con gli strumenti di marketing all-in-one di Squarespace

Pagine e contenuto

Privacy e sicurezza

Scopri come creare e modificare il tuo sito con pagine, sezioni e blocchi

SEO

Ottieni informazioni su sicurezza, SSL, privacy dei dati e politiche su Squarespace

Scopri come ottimizzare il tuo sito per i motori di ricerca con le migliori parole chiave e contenuti

Acuity Scheduling

Prenota e gestisci gli appuntamenti con la prenotazione online integrata

Problemi tecnici e contatti

Risolvi i problemi tecnici e di velocità relativi al tuo sito

Modelli e design

Scopri come personalizzare tipi di carattere, colori e altre funzionalità di progettazione

Impara con il video

Tutto sulle immagini

7 video

Introduzione a Commerce

4 video

Crea il tuo primo sito Squarespace

1 video

Pagine e navigazione

7 video

Vedi tutti i video

Forum della community

Unisciti alla nostra community attiva di utenti e professionisti Squarespace per consigli, ispirazione e best practice.

Forum Squarespace

Webinar Squarespace

Forum Circle

Sessioni online gratuite dove imparerai le basi e perfezionerai le tue abilità Squarespace. Tutti sono i benvenuti, non è richiesto alcun sito Web.

Prossimi webinar

Assumi un esperto con Marketplace

Gli Squarespace Expert possono aiutarti a rifinire un sito esistente o crearne uno nuovo da zero.

Cerca un esperto

Non riesci a trovare quello che stai cercando?

Ti aiuteremo a trovare una risposta o ti metteremo in contatto con l'Assistenza clienti tramite chat live o e-mail.

Contattaci

Nessun risultato

Prodotti digitali

Guida introduttiva ai prodotti digitali

Paywall e piani tariffari

Pagine corso

Siti dei membri

Una persona con in mano uno smartphone che guarda il sito Web di Colima

Un esempio di sito Web Squarespace

Un esempio di nome dominio per un sito Web Squarespace

Uno screenshot della barra degli strumenti Google Workspace

Uno screenshot del prodotto Commerce nella piattaforma Squarespace

Un esempio di immagini per l'invio di campagne e-mail

Uno screenshot del prodotto Acuity nella piattaforma Squarespace

Uno screenshot dell'Aree membri nella piattaforma Squarespace

Una foto astratta di forme e colori

Un paio di scarpe bianche

Un iPad che mostra un sito Web di e-commerce creato con Squarespace

Una persona con in mano uno smartphone che guarda un sito Web creato con Squarespace

Uno screenshot degli strumenti di modifica sulla piattaforma Squarespace

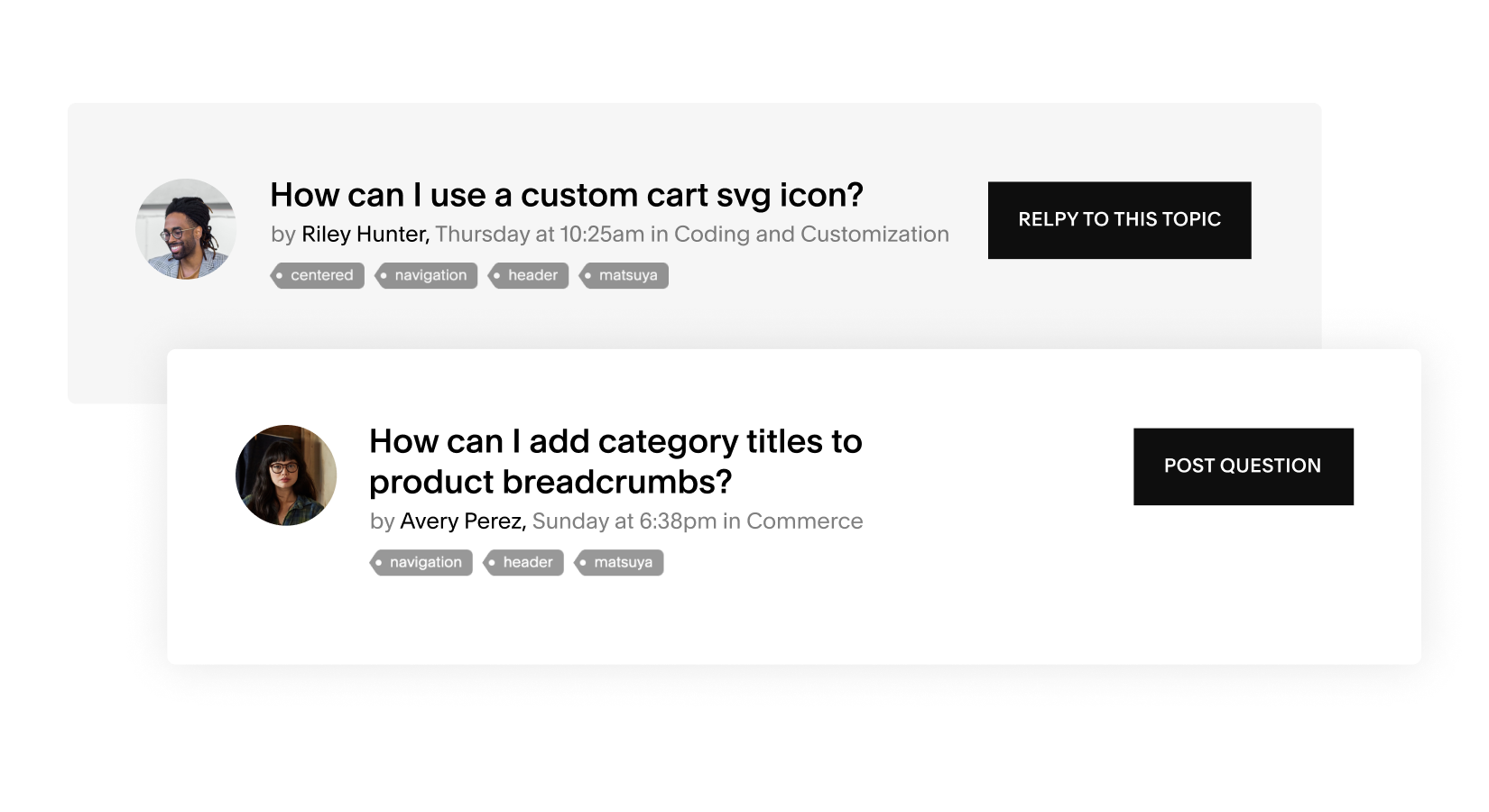

Esempi di domande sul forum della community di Squarespace

Un esempio di biografia di uno Squarespace Expert

Un sito Web Squarespace con il chatbot del servizio clienti Squarespace aperto sullo schermo

Chiudi

Come valuteresti la tua esperienza con il Centro assistenza?

Piuttosto insoddisfatto

Molto insoddisfatto

Né soddisfatto né insoddisfatto

Piuttosto soddisfatto

Feedback

Molto soddisfatto

Avanti

Puoi spiegarci il motivo? (Facoltativo)

Com'è stata la tua esperienza nel cercare aiuto oggi?

Molto difficile

Piuttosto difficile

Né facile né difficile

Piuttosto facile

Molto facile

Perché? (Facoltativo)

Non sono sicuro

Hai trovato la risposta che cercavi nel Centro assistenza?

No, il mio problema non è stato risolto

L'ho trovato altrove

Sì, in parte

Sì, completamente

Dove hai trovato la risposta migliore?

Seleziona

Video

Guida

Webinar

Forum

Altro

Grazie per il tuo feedback

Impossibile scaricare la trascrizione. Riprova.

We use machine translation to translate guides in this language. Human editors don’t review the content for quality after it’s translated.

Read the English version

Acuity Scheduling

Non riesci ad accedere?

Non ho un account

Login

Accedi al tuo account per personalizzare la tua esperienza.

Per quale account hai bisogno di aiuto oggi?

Forum Community

Ricevi assistenza dalla nostra community in merito alle personalizzazioni avanzate.

Esplora il Forum

Webinar

Iscriviti a una sessione interattiva durante la quale i nostri esperti ti aiuteranno a comprendere le basi di Squarespace.

Partecipa a un webinar

Non riesci a trovare quello che stai cercando?

Ti aiuteremo a trovare la risposta o a metterti in contatto con un consulente.

Contattaci

Ricevi assistenza dalla nostra community

Ricevi assistenza dalla nostra community in merito alle personalizzazioni avanzate.

cerca nei forum

Affidati a uno Squarespace Expert

Fatti notare online con l'aiuto di un designer o di uno sviluppatore esperto.

trova l'esperto che fa per te

In questa guida

La guida è stata utile?

Le persone hanno visto anche

Accesso a questa funzionalità

Nota

Suggerimento

Avviso

Hai trovato le informazioni che stavi cercando?

Sto ancora navigando

Grazie per il feedback.

Errore di copia del testo negli appunti

Testo copiato correttamente negli appunti

Copia

In questa guida

Il tuo modulo è stato inviato correttamente!

È stata inviata un'e-mail di conferma al tuo indirizzo. Ti risponderemo il prima possibile.

torna su Squarespace

Non riesci a trovare quello che ti serve?Ecco come puoi contattarci.

Inviaci una e-mail

Chat dal vivo

Inviaci un messaggio e leggi la nostra risposta quando preferisci.

Conversazioni in tempo reale e risposte immediate dal nostro pluripremiato team di assistenza clienti.

24 ore al giorno

7 giorni alla settimana

Dal lunedì al venerdì

dalle 4:00 alle 20:00 EST

Da lunedì a venerdì

dalle 4:00 alle 20:00 EDT

invia un'e-mail

avvia la chat dal vivo

Chat dal vivo attualmente non disponibile.

{"schedules":[{"id":50095,"name":"Business Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2014-10-03T22:10:16Z","updated_at":"2025-01-06T14:24:27Z","intervals":[{"start_time":1200,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":8400}]},{"id":360000418191,"name":"Social Team Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2020-09-01T09:34:47Z","updated_at":"2020-09-03T13:07:03Z","intervals":[{"start_time":240,"end_time":1440},{"start_time":1680,"end_time":2880},{"start_time":3120,"end_time":4320},{"start_time":4560,"end_time":5760},{"start_time":6000,"end_time":7200},{"start_time":7440,"end_time":8640},{"start_time":8880,"end_time":10080}]},{"id":360000421112,"name":"Account Management VIP Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2020-09-29T20:18:51Z","updated_at":"2021-03-03T10:38:13Z","intervals":[{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":8640}]},{"id":5995548166541,"name":"Live Chat Business Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2022-05-04T15:10:42Z","updated_at":"2025-02-18T09:19:59Z","intervals":[{"start_time":1680,"end_time":2640},{"start_time":3120,"end_time":4080},{"start_time":4560,"end_time":5520},{"start_time":6000,"end_time":6960},{"start_time":7440,"end_time":8400}]},{"id":5995587746445,"name":"Live Chat AUS/NZ Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2022-05-04T15:12:38Z","updated_at":"2025-02-19T19:47:58Z","intervals":[{"start_time":1200,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":8400}]},{"id":18405093826701,"name":"[Inactive] Live Chat Acuity Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2023-08-10T16:06:56Z","updated_at":"2024-04-29T14:57:38Z","intervals":[{"start_time":1680,"end_time":2610},{"start_time":3120,"end_time":4050},{"start_time":4560,"end_time":4920},{"start_time":5220,"end_time":5340},{"start_time":5400,"end_time":5490},{"start_time":6000,"end_time":6360},{"start_time":6420,"end_time":6600},{"start_time":6660,"end_time":6780},{"start_time":6840,"end_time":6930},{"start_time":7440,"end_time":8370}]},{"id":21322019776781,"name":"Email - IntouchCX (COSO-3757)","time_zone":"Eastern Time (US & Canada)","created_at":"2023-11-14T14:54:21Z","updated_at":"2024-04-29T14:59:04Z","intervals":[{"start_time":960,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":7980}]},{"id":21322160612877,"name":"Email - 24/7 teams (COSO-3757)","time_zone":"Eastern Time (US & Canada)","created_at":"2023-11-14T14:59:39Z","updated_at":"2024-04-29T14:59:13Z","intervals":[{"start_time":0,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":8640},{"start_time":8640,"end_time":10080}]},{"id":25217370917901,"name":"Product Support Business Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2024-03-21T17:12:42Z","updated_at":"2024-05-07T11:37:22Z","intervals":[{"start_time":1620,"end_time":2700},{"start_time":3060,"end_time":4140},{"start_time":4500,"end_time":5580},{"start_time":5940,"end_time":7020},{"start_time":7380,"end_time":8460}]},{"id":26294188481165,"name":"Live Chat - Acuity CUSU HVCS (COSO-4219)","time_zone":"Eastern Time (US & Canada)","created_at":"2024-04-29T14:59:37Z","updated_at":"2025-02-13T16:10:24Z","intervals":[{"start_time":1680,"end_time":2640},{"start_time":3120,"end_time":4080},{"start_time":4560,"end_time":5520},{"start_time":6000,"end_time":6960},{"start_time":7440,"end_time":8400}]},{"id":28799929362829,"name":"Live Chat - Acuity","time_zone":"Eastern Time (US & Canada)","created_at":"2024-07-29T17:52:26Z","updated_at":"2025-02-18T10:31:08Z","intervals":[{"start_time":1680,"end_time":2640},{"start_time":3120,"end_time":4080},{"start_time":4560,"end_time":5520},{"start_time":6000,"end_time":6960},{"start_time":7440,"end_time":8400}]},{"id":30299777743117,"name":"New schedule","time_zone":"Paris","created_at":"2024-09-16T17:00:21Z","updated_at":"2024-09-16T17:16:32Z","intervals":[{"start_time":2040,"end_time":2400},{"start_time":3480,"end_time":3840},{"start_time":4920,"end_time":5280},{"start_time":6360,"end_time":6720},{"start_time":7800,"end_time":8160}]}],"url":"https://squarespace.zendesk.com/api/v2/business_hours/schedules"}

Squarespace Payments

Area prodotti Squarespace Payments

Introduzione a Squarespace Payments

Gestire i pagamenti e i versamenti con Squarespace Payments

Cosa succede in caso di saldo negativo con Squarespace Payments

Gestire il proprio account Squarespace Payments

Accettare pagamenti

Scopri come elaborare le transazioni quando vendi i tuoi prodotti su Squarespace

Pagamento completato

Si è verificato un errore durante l'elaborazione della tua azione. Riprova.

Messaggio non recapitato. Clicca per riprovare.

Si è verificato un errore durante l'elaborazione della carta.

Riprova o di utilizza un'altra carta.

Modulo non inviato. Clicca su un punto qualsiasi del modulo per riprovare.

Sincronizza la conversazione e continua a inviarci messaggi con la tua app preferita.

Ricevi una notifica in caso di risposta.

Le mie conversazioni

1 minuto fa

Proprio ora

{value} minuti fa

1 ora fa

{value} ore fa

Ieri

DD/MM/YY

{user} ha inviato un messaggio

Qualcuno

{user} ha inviato un file

{user} ha inviato un modulo

{user} ha inviato un'immagine

{user} ha compilato un modulo

{user} ha inviato una richiesta di localizzazione

Te

DD MMMM YYYY, hh:mm A

Riconnessione...

Connessione ripristinata.

Offline. Non riceverai i messaggi.

Impossibile caricare le conversazioni.

Cambia il mio indirizzo e-mail

Per ricevere una notifica via e-mail al ricevimento di una risposta, inserisci il tuo indirizzo di posta elettronica.

Email

Il tuo indirizzo e-mail

Inserisci un indirizzo e-mail valido.

Invia

Carica altro

Recupero della cronologia...

Limite di dimensione massima del file superato ({size})

Questa voce è obbligatoria

Tipo di file non supportato.

L'e-mail non è valida

Deve contenere almeno ({characters}) caratteri

Non deve contenere più di ({characters}) caratteri

Fai una scelta...

Sembra che ci sia un problema

Per contattarci via e-mail basta inviare un messaggio al nostro indirizzo di posta elettronica e ti risponderemo entro poco tempo:

Come possiamo aiutarti?

Clicca per ricaricare l'immagine.

Clicca per visualizzare l'immagine {size}.

Digita un messaggio...

Anteprima non disponibile.

Inviaci un messaggio qui sotto o tramite la tua app preferita.

Premi INVIO per ogni voce

Si è verificato un errore nel tentativo di generare un link per questo canale. Riprova.

Per contattarci tramite LINE, effettua la scansione di questo codice QR utilizzando l'app LINE e inviaci un messaggio.

Sincronizza la conversazione

Il tuo browser non supporta i servizi di localizzazione oppure sono stati disattivati. Indica la tua posizione.

Questo sito web non può accedere alla tua posizione. Digita la tua posizione.

Impossibile inviare la posizione

Questo sito web non può accedere alla tua posizione. Consenti l'accesso nelle impostazioni o digita la tua posizione.

Si è verificato un errore durante l'invio del messaggio. Riprova.

({count}) nuovi messaggi

{value} giorno/i fa

({count}) nuovo messaggio

Proprio ora

{value} minuto/i fa

{value} ora/e fa

Consegna effettuata

hh:mm A

Letto

La dimensione massima del messaggio è stata superata ({size}).

Invio in corso...

Sincronizza questa conversazione effettuando la connessione alla tua app di messaggistica preferita per proseguire la conversazione come preferisci.

Collega il tuo account Facebook Messenger per ricevere una notifica quando ricevi una risposta e continuare la conversazione su quest'ultimo.

Nuova conversazione

Altri canali

Connessione effettuata

Salve 👋\nPer prima cosa, vorremmo chiederti qualche informazione in più su di te:

Connessione effettuata come {username}

Il tuo nome

Email

Digita il tuo nome...

Grazie! Come possiamo aiutarti?

nome@azienda.com

Invia

Ti invieremo una notifica qui e via e-mail all'indirizzo {email} non appena avremo risposto.

Impostazioni

Posizione

Annulla

Non siamo riusciti a contattare questo numero. Riprova o usane uno diverso.

Collega il tuo numero di telefono per ricevere una notifica quando ricevi una risposta e continuare la conversazione via SMS.

Cambia il mio numero

Per confermare il tuo numero di telefono, controlla la presenza di nuovi messaggi sul numero {number}.

Inserisci un numero di telefono valido.

Invia

Il collegamento a {appUserNumber} è stato annullato.

In sospeso

Inizia a scrivere

Si è verificato un errore durante l'invio di un messaggio al tuo numero.

Inviami un SMS

Di recente è stata richiesta una connessione per quel numero. Riprova tra 1 minuto.

Di recente è stata richiesta una connessione per quel numero. Riprova tra {minuti} minuti.

Sincronizza la conversazione

Si è verificato un errore. Riprova.

Messaggio non recapitato. Tocca per riprovare.

Modulo non inviato. Tocca un punto qualsiasi del modulo per riprovare.

Collega il tuo account Telegram per ricevere una notifica quando ricevi una risposta e continuare la conversazione su quest'ultimo.

Tipo di messaggio non supportato.

Tipo di azione non supportato.

File

File non valido.

Immagine

Il tuo file contiene un virus ed è stato rifiutato

Collega il tuo account Viber per ricevere una notifica quando ricevi una risposta e continuare la conversazione su quest'ultima. Per iniziare, effettua la scansione del codice QR utilizzando l'app Viber.

Collega il tuo account Viber per ricevere una notifica quando ricevi una risposta e continuare la conversazione su quest'ultima. Per iniziare, installa l'app Viber e tocca Connetti.

Si è verificato un errore durante l'acquisizione del codice QR di Viber. Riprova.

Collega il tuo account WeChat per ricevere una notifica quando ricevi una risposta e continuare la conversazione su quest'ultima. Per iniziare, effettua la scansione del codice QR utilizzando l'app WeChat.

Si è verificato un errore durante il recupero del codice QR di WeChat. Riprova.

Collega il tuo account WeChat per ricevere una notifica quando ricevi una risposta e continuare la conversazione su quest'ultima. Per iniziare, effettua la scansione del codice QR utilizzando l'app WeChat. Per iniziare, salva l'immagine di questo codice QR e caricala nello <a href=\'weixin://dl/scan\'>scanner di codici QR.

Sincronizza il tuo account su WhatsApp tramite la scansione del codice QR o cliccando sul link in basso.\nIn seguito, invia il messaggio precompilato per confermare la richiesta di sincronizzazione. (Il tuo codice: {{code}})

Sincronizza il tuo account su WhatsApp cliccando sul link in basso.\nIn seguito, invia il messaggio precompilato per confermare la richiesta di sincronizzazione. (Il tuo codice: {{code}})

Si è verificato un errore durante il recupero delle informazioni sul collegamento di WhatsApp. Riprova.

In questo momento, i tempi di attesa in chat sono più lunghi a causa dell'elevato volume di richieste. Il modo più veloce per comunicare con un nostro collaboratore dell'assistenza è rimanere in attesa.

Non è necessario attendere nella coda della chat per ricevere una risposta. Invierò la tua trascrizione al nostro team. Ti risponderemo via e-mail il prima possibile.

In questo modo uscirai dalla coda della chat e perderai il tuo posto in coda. Puoi tornare in coda in qualsiasi momento aprendo una nuova chat.

Nessuna modalità trovata

In attesa di un agente...

Inviare un'e-mail?

Annullare la richiesta di chat?

Annulla chat

Invia e-mail

Conferma

Invia un'e-mail

Continua ad attendere

Assistente Squarespace

Visualizza stato della coda

Il supporto chat live per questa lingua è attualmente offline.

Il chatbot non funziona?

Segnalalo al nostro team.

Ciao

ti aiuterò ad avere l'aiuto di cui hai bisogno.

Il nostro assistente automatizzato si metterà al lavoro per trovare una risposta rapida.

Vuoi parlare con una persona reale? L'assistente di supporto può metterti in contatto con un membro del nostro team tramite live chat o e-mail.

contattaci

Come ottenere aiuto

Inizia con il nostro Assistente di supporto automatico

Ricevi risposte rapide dal nostro chatbot in qualsiasi momento. Digita la tua domanda e riceverai subito assistenza.

Invia un'e-mail o chatta con il nostro team di assistenza

Hai bisogno di aiuto? Il nostro Assistente di supporto ti metterà in contatto con un consulente del nostro team di assistenza clienti.

Ti aiuterò ad avere l'aiuto di cui hai bisogno.

Accedi per ricevere assistenza con maggiore rapidità.

La chat dal vivo non è disponibile

Chatta in inglese

Chat Live

La chat dal vivo non è attualmente disponibile. Inviaci un'e-mail e ti risponderemo entro 12 ore.

Al momento, la chat dal vivo non è disponibile nella tua lingua. Chatta con noi in inglese, oppure inviaci un'e-mail e ti risponderemo entro 12 ore.

La chat dal vivo è disponibile nella tua lingua dal lunedì al venerdì, dalle 10:00 alle 16:00 CET.

La chat dal vivo non è disponibile nella tua lingua. Inviaci un'e-mail e ti risponderemo entro 12 ore.

La chat dal vivo non è disponibile nella tua lingua. Chatta con noi in inglese, oppure inviaci un'e-mail e ti risponderemo entro 12 ore.

Conversazioni in tempo reale e risposte immediate dal nostro pluripremiato team di assistenza clienti.

Dal lunedì al venerdì, dalle 10:00 alle 16:00 CET

La chat dal vivo non è attualmente disponibile. Inviaci un'e-mail e ti risponderemo entro 12 ore.

La chat dal vivo è disponibile nella tua lingua dal lunedì al venerdì, dalle 10:00 alle 16:00 CET.

Vai alla chat