Search Results

All Categories

Clear

Search

Apply

Search in

Category

Reset

Filter by

Prev

Next

Guides

Log out

Account dashboard

Select your language

VIDEOS

https://learning.squarespace.com

WEBINARS

https://forum.squarespace.com

FORUM

/hc/requests/new#choose-topic

CONTACT US

LIVE CHAT: CLOSED

LIVE CHAT: OPEN

Log in

See All Results

Send

Choose a topic

We think this will help:

Still need to contact us?

Real-time conversation and immediate answers.

Live Chat

Monday - Friday:

4:00AM to 8:00PM EST

Send us a message and read our answer when it’s convenient for you.

Email

Contact us by email to get help with this topic.

24 hours a day

7 days a week

Log into Squarespace

Go back

This guide is not available in English. You will be redirected in 5 seconds

We currently offer live chat support in English only.

EMAIL SUPPORT IN SPANISH

CHAT IN ENGLISH

Squarespace 5 Help

For questions about the legacy Squarespace 5 platform, please visit its Help Center:

Back

Regain access to your account or site

If you’ve tried to

recover your Squarespace or Acuity account and still can’t access it, we’re here to help. Please enter as much information as you can, but if you’re not sure about specific details, provide your best guess.

Before you begin:

• Did you already try to recover your account through the login page? We’ll ask you to try that first if you haven’t yet.

• For your security, we’ll only provide account details to the account holder.

• For help recovering a Google Workspace account, contact us here.

Email address where we can contact you.

What situation led to the trouble accessing your account?

URLs of any websites connected to the account. Enter as many domains as possible.

Please attach both of the following documents:

• A government-issued ID. For example, a driver’s license, passport or permanent resident card.

• A bank statement that shows the bank header, bank accountholder name, and the most recent Squarespace charge. You are free to obscure other personal information in the document. (Not required for two-factor authentication issues.)

Note:

• If you entered multiple websites above, attach statements showing the most recent charge associated with every site.

• Ensure your files are .jpg or .png so we can view them.

Request Account Access

Follow these steps:

Learn More

Request a Refund

Hear back in 2 business days.

If you have a tax exemption certificate, attach it here. .pdf, .png, .jpeg file formats are accepted.

Use this form to submit a request about exemption from sales tax collected for Squarespace payments.

Enter the details of your request here. If you’re not based in a country or state where we collect taxes, and you believe we shouldn’t collect taxes from you, please explain.

If you have feedback about how we collect sales tax, submit it here.

Your feedback helps make Squarespace better, and we review every request we receive. Please note that we can't reply individually, but we’ll contact you if we need more details.

General sales tax feedback

Request an exemption from sales tax

Tell us more

Upload a screenshot of the issue you’re having, or the site content you'd like to modify, so we can help you more quickly. Learn how to take a screenshot here:

https://sqsp.link/hMaBjwSquarespace respects intellectual property rights and expects its users to do the same. Squarespace responds expeditiously to claims of copyright infringement committed using the Services.

To submit a notice of claimed copyright infringement, you will need to submit a notice of infringement using the form below.

Please be aware that in instances where Squarespace is merely the Registrar and does not provide web hosting services, Squarespace does not control the content and the content does not reside on Squarespace’s servers; you will need to resolve the claimed copyright infringement directly with the site owner or the web hosting service provider.

Squarespace's response to notices of alleged copyright infringement may include the removal or restriction of access to allegedly infringing material. Please note that information provided in a notice of copyright infringement may be forwarded to the user who posted the allegedly infringing content or the site owner.

Squarespace is committed to providing a service to our customers that is safe and trusted. If you believe that there is content on Squarespace that is illegal, please submit a notice of illegal content to Squarespace using the form below. We have introduced this reporting channel to customers in accordance with Article 16 of the European Union’s Digital Services Act (Regulation (EU) 2022/2065) (‘DSA’).

Report malware

Squarespace Domains LLC and Squarespace Domains II LLC are committed to providing a safe and trusted service. If you have a concern about a domain name registered with Squarespace, you can submit a report to let us know.

Malware, or malicious software, are programs designed to disrupt, damage, or gain access to a computer without the owner's knowledge. Malware includes viruses, spyware, ransomware, and other unwanted software. Malware being used through multiple sources are referred to as botnets.

To learn more about reporting other suspicious domain activity to Squarespace, visit

Reporting domain name abuse.

Before you begin:

• Ensure the domain you're reporting to us is

registered and managed through Squarespace.

• Visit our

Terms of Service and

Acceptable Use Policy to review our policies about abuse and fraudulent or illegal activity.

Report phishing or pharming

Squarespace Domains LLC and Squarespace Domains II LLC are committed to providing a safe and trusted service. If you have a concern about a domain name registered with Squarespace, you can submit a report to let us know.

Phishing is a type of fraud that attempts to deceive users into sharing sensitive information like credit card information, passwords, or account details.

Where phishing attempts to deceive users into sharing sensitive information, pharming attempts to redirect users to fraudulent sites through modified/hijacked DNS, instead of where the user originally attempted to go.

To learn more about reporting other suspicious domain activity to Squarespace, visit

Reporting domain name abuse.

Before you begin:

• Ensure the domain you're reporting to us is

registered and managed through Squarespace.

• Visit our

Terms of Service and

Acceptable Use Policy to review our policies about abuse and fraudulent or illegal activity.

Report spam

Squarespace Domains LLC and Squarespace Domains II LLC are committed to providing a safe and trusted service. If you have a concern about a domain name registered with Squarespace, you can submit a report to let us know.

Spam encompasses any unsolicited bulk emails sent without the recipient's consent. This includes “spamvertising” and sending emails that violate the

CAN-SPAM Act.

To learn more about reporting other suspicious domain activity to Squarespace, visit

Reporting domain name abuse.

Before you begin:

• Ensure the domain you're reporting to us is

registered and managed through Squarespace.

• Visit our

Terms of Service and

Acceptable Use Policy to review our policies about abuse and fraudulent or illegal activity.

Temporary text

Report Whois contact inaccuracy

Squarespace Domains LLC and Squarespace Domains II LLC are committed to providing a safe and trusted service. If you have a concern about a domain name registered with Squarespace, you can submit a report to let us know.

Domain owners are required to keep their Whois records up-to-date. Inaccurate, outdated or intentionally false domain contact details can be reported through this form.

To learn more about reporting other suspicious domain activity to Squarespace, visit

Reporting domain name abuse.

Before you begin:

• Ensure the domain you're reporting to us is

registered and managed through Squarespace.

• Visit our

Terms of Service and

Acceptable Use Policy to review our policies about abuse and fraudulent or illegal activity.

Squarespace respects intellectual property rights and expects its users to do the same. Squarespace responds expeditiously to claims of trademark infringement committed using the Services. To submit a notice of claimed trademark infringement, you will need to submit a notice of infringement using the form below.

Please be aware that in instances where Squarespace is merely the Registrar and does not provide web hosting services, Squarespace does not control the content and the content does not reside on Squarespace’s servers; you will need to resolve the claimed trademark infringement directly with the site owner or the web hosting service provider.

Squarespace's response to notices of alleged trademark infringement may include the removal or restriction of access to allegedly infringing material. Please note that information provided in a notice of trademark infringement may be forwarded to the user who posted the allegedly infringing content or the site owner.

Please complete all required fields.

Live chat is temporarily closed. Email is available 24/7.

#

Squarespace Scheduling is now officially Acuity Scheduling. For help setting up appointments, search “Acuity”, or find related guides under “Acuity Scheduling”.

#

#

Please use this form to submit a request regarding a deceased Squarespace customer’s site or Acuity Scheduling account. Our deepest condolences go out to you and your family during this time, and we appreciate your patience as we work through your request.

Due to privacy concerns and restrictions, we unfortunately can't provide you with administrative control of the site. However, if an immediate family member or legal representative completes the form below, we may be able to grant Billing permissions so the site can remain active or cancel any active subscriptions.

Note that Billing permissions don't include the ability to edit the site's content. You can read more about this

here.

A note regarding Squarespace 5 sites:

Squarespace 5, our legacy platform, doesn't allow permissions to be edited. However, we can cancel or remove the site.

A note regarding Acuity Scheduling accounts:

Granting billing permissions is not possible on Acuity accounts without a Squarespace login. However, we can cancel or remove the account.

Submit a request about a deceased customer's account

Subject

Any comments, requests, or concerns we should know?

Please attach the following documents:

• An image of your government-issued ID, such as a driver’s license, passport, military ID, or permanent resident card. This is for proof of your relationship to the deceased.

• An image of the deceased person’s obituary, death certificate, and/or other documents.

• Any additional documents, such as Legal Representation documentation.

Send us a message. Business hours are Monday - Friday, 5:30AM to 8PM EST. Messages sent outside these hours will receive a response within 12 hours.

Monday - Friday:

4:00AM to 8:00PM EST

Squarespace Help Center

Find answers and resources

See More Results

Browse by product

Websites

Adding content with blocks

Formatting your images for display

Changing colors

SEO checklist

Domains

Connecting a domain

Moving a domain to another site

Google Domains migration to Squarespace

Transferring a domain

Commerce

Adding products to your store

Connecting a payment processor

Creating discounts

Setting up taxes

Email Campaigns

Building mailing lists

Creating sender profiles

Email campaign best practices

Getting started with Squarespace Email Campaigns

Google Workspace

Using Google Workspace with Squarespace

Adding more Google Workspace users

Signing up for Google Workspace

Renaming a Google Workspace user

Acuity Scheduling

Adding Acuity to your website

Starting an Acuity Scheduling trial

Creating and editing appointment types

Acuity Scheduling FAQ

Acuity Help Center

What is Acuity Scheduling?

Acuity Scheduling pricing, billing, and invoices

Member Areas

Creating gated content

Customizing the Member Areas experience

Managing members

Getting started with Member Areas

Guides by topic

Show more

Show less

Getting started

Everything you need to start and launch your site on Squarespace

Account

Analytics

Get help with your account settings, password, and site contributors

Billing

View reports to gain insight into visitor engagement and sales

Get help with your plans, payments, and subscriptions

Commerce

Learn how to set up, manage, and grow your online store

Domains

Get step-by-step help with registering, transferring, and connecting domains

Google Workspace and custom email

Images and videos

Set up a custom email address with your domain

Make your site stand out with images, videos, and banners

Integrations and extensions

Add third-party integrations to help you manage, optimize, and expand your site

Marketing

Spread the word about your business with Squarespace’s all-in-one marketing tools

Pages and content

Privacy and security

Learn how to build and edit your site with pages, sections, and blocks

SEO

Get information about security, SSL, data privacy, and policies about Squarespace

Learn how to optimize your site for search engines with the best keywords and content

Acuity Scheduling

Book and manage appointments with integrated online booking

Technical issues and contact us

Troubleshoot technical and speed issues with your site

Templates and design

Learn how to customize fonts, colors, and other design features

Learn by video

All About Images

7 videos

Introducing Commerce

4 videos

Build your first Squarespace site

1 video

Your Pages & Navigation

7 videos

See all videos

Community forums

Join our active community of Squarespace users and professionals for advice, inspiration, and best practices.

Squarespace Forum

Squarespace webinars

Circle Forum

Free online sessions where you'll learn the basics and refine your Squarespace skills. Everyone is welcome—no website required.

Upcoming Webinars

Hire an Expert with Marketplace

Squarespace Experts can help you polish an existing site, or build a new one from scratch.

Browse Experts

Can't find what you're looking for?

We'll help you find an answer or connect you with Customer Support through live chat or email.

Contact Us

No results

Digital Products

Getting started with Digital Products

Paywalls and Pricing plans

Course pages

Member sites

A person holding a smart phone and looking at Colima's website

A Squarespace website example

A sample domain name for a Squarespace website

A screenshot of Google Workspace toolbar

A screenshot of the Commerce product in the Squarespace platform

A sample imagery for sending email campaigns

A screenshot of the Acuity product in the Squarespace platform

A screenshot of the member area product in the Squarespace platform

An abstract photo of shapes and colors

A pair of white shoes

An iPad showcasing an e-commerce website built with Squarespace

A person holding a smart phone and looking at a website built with Squarespace

A screenshot of editing tools on the Squarespace platform

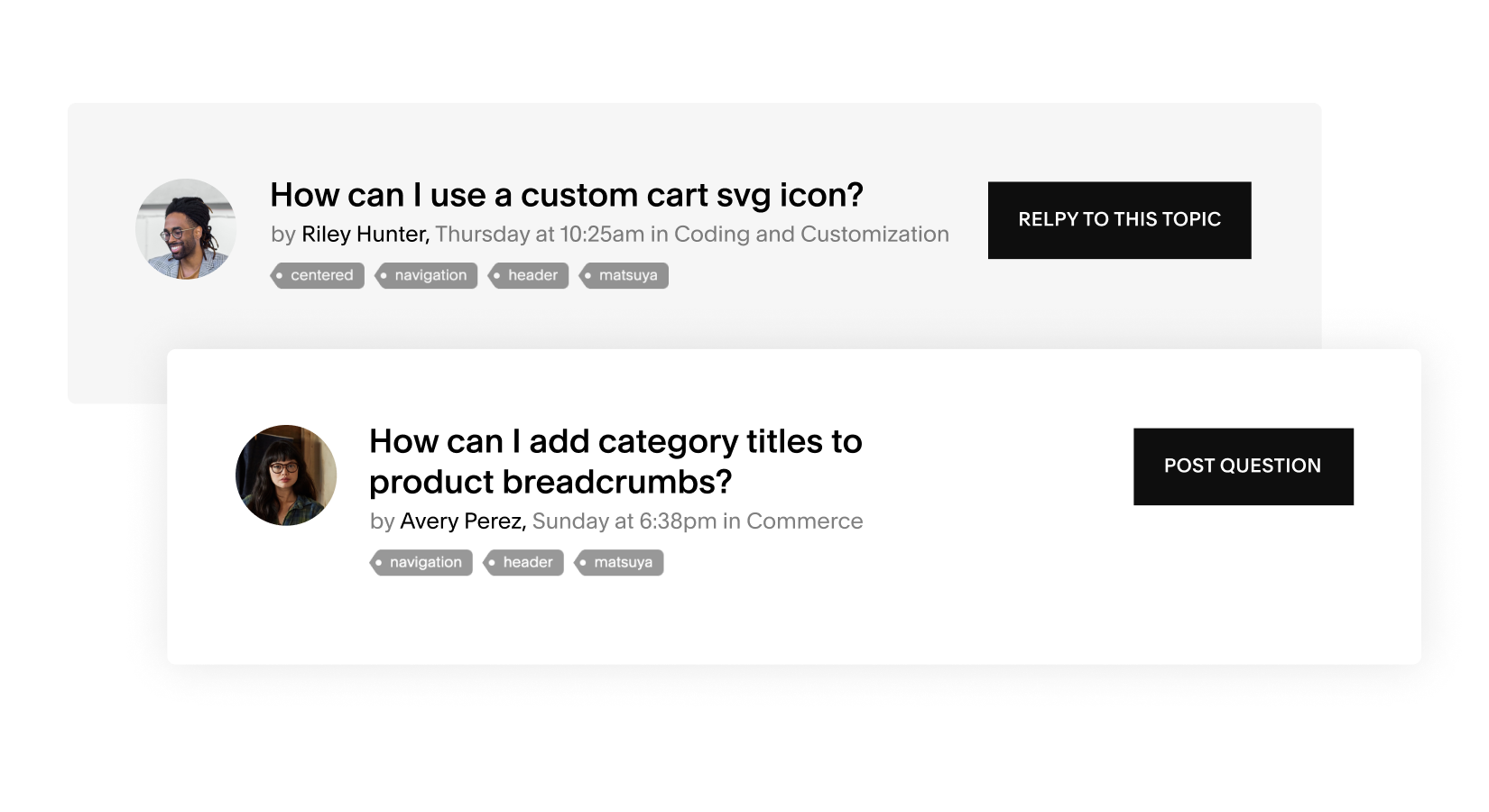

Examples of questions in the Squarespace Community Forum

An example of a Squarespace Expert's bio

A Squarespace website with the Squarespace Customer Service Chatbot open on the screen

Close

How would you rate your experience with the Help Center?

Somewhat dissatisfied

Very dissatisfied

Neither satisfied nor dissatisfied

Somewhat satisfied

Feedback

Very satisfied

Next

Can you tell us why? (Optional)

How was your experience looking for help today?

Very difficult

Somewhat difficult

Neither easy nor difficult

Somewhat easy

Very easy

Why's that? (Optional)

I'm not sure

Did you find the answer you were looking for in the Help Center?

No, my issue was not resolved

I found it elsewhere

Yes, partially

Yes, completely

Where did you best find your answer?

Select

Video

Guide

Webinars

Forum

Other

Thanks for your feedback

Can’t download the transcript. Please try again.

We use machine translation to translate guides in this language. Human editors don’t review the content for quality after it’s translated.

Read the English version

Acuity Scheduling

Can’t log in?

I don’t have an account

Log in

Log into your account so we can customize your experience.

Which account do you need help with today?

Community Forum

Get help from our community on advanced customizations.

Explore the Forum

Webinars

Sign up for an interactive session where our experts walk you through Squarespace basics.

Join a Webinar

Can't find what you're looking for?

We'll help you find the answer or connect with an advisor.

Contact Us

Get help from our community

Get help from our community on advanced customizations.

search in the forums

Hire a Squarespace Expert

Stand out online with the help of an experienced designer or developer.

get matched

In this guide

Was this guide helpful?

People also viewed

Accessing this feature

Note

Tip

Warning

Did you find the information you were looking for?

Still Browsing

Thank you for your feedback.

Error copying text to clipboard

Successfully copied text to clipboard

Copy

In this guide

Your form was submitted successfully!

A confirmation email has been sent to your address. We will get back to you as soon as we can.

return to Squarespace

Can’t find what you need? Here’s how to contact us.

Email Us

Live Chat

Send us a message and read our answer when it’s convenient for you.

Real-time conversations and immediate answers from our award-winning Customer Support team.

24 hours a day

7 days a week

Monday to Friday

4am to 8pm EST

Monday to Friday

4am to 8pm EDT

send an email

start live chat

Live chat currently unavailable.

{"schedules":[{"id":50095,"name":"Business Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2014-10-03T22:10:16Z","updated_at":"2025-01-06T14:24:27Z","intervals":[{"start_time":1200,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":8400}]},{"id":360000418191,"name":"Social Team Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2020-09-01T09:34:47Z","updated_at":"2020-09-03T13:07:03Z","intervals":[{"start_time":240,"end_time":1440},{"start_time":1680,"end_time":2880},{"start_time":3120,"end_time":4320},{"start_time":4560,"end_time":5760},{"start_time":6000,"end_time":7200},{"start_time":7440,"end_time":8640},{"start_time":8880,"end_time":10080}]},{"id":360000421112,"name":"Account Management VIP Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2020-09-29T20:18:51Z","updated_at":"2021-03-03T10:38:13Z","intervals":[{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":8640}]},{"id":5995548166541,"name":"Live Chat Business Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2022-05-04T15:10:42Z","updated_at":"2025-02-13T14:33:33Z","intervals":[{"start_time":1680,"end_time":2640},{"start_time":3120,"end_time":4080},{"start_time":4560,"end_time":5520},{"start_time":6000,"end_time":6330},{"start_time":7440,"end_time":8400}]},{"id":5995587746445,"name":"Live Chat AUS/NZ Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2022-05-04T15:12:38Z","updated_at":"2025-02-13T14:33:46Z","intervals":[{"start_time":1200,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":6330},{"start_time":7200,"end_time":8400}]},{"id":18405093826701,"name":"[Inactive] Live Chat Acuity Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2023-08-10T16:06:56Z","updated_at":"2024-04-29T14:57:38Z","intervals":[{"start_time":1680,"end_time":2610},{"start_time":3120,"end_time":4050},{"start_time":4560,"end_time":4920},{"start_time":5220,"end_time":5340},{"start_time":5400,"end_time":5490},{"start_time":6000,"end_time":6360},{"start_time":6420,"end_time":6600},{"start_time":6660,"end_time":6780},{"start_time":6840,"end_time":6930},{"start_time":7440,"end_time":8370}]},{"id":21322019776781,"name":"Email - IntouchCX (COSO-3757)","time_zone":"Eastern Time (US & Canada)","created_at":"2023-11-14T14:54:21Z","updated_at":"2024-04-29T14:59:04Z","intervals":[{"start_time":960,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":7980}]},{"id":21322160612877,"name":"Email - 24/7 teams (COSO-3757)","time_zone":"Eastern Time (US & Canada)","created_at":"2023-11-14T14:59:39Z","updated_at":"2024-04-29T14:59:13Z","intervals":[{"start_time":0,"end_time":1440},{"start_time":1440,"end_time":2880},{"start_time":2880,"end_time":4320},{"start_time":4320,"end_time":5760},{"start_time":5760,"end_time":7200},{"start_time":7200,"end_time":8640},{"start_time":8640,"end_time":10080}]},{"id":25217370917901,"name":"Product Support Business Hours","time_zone":"Eastern Time (US & Canada)","created_at":"2024-03-21T17:12:42Z","updated_at":"2024-05-07T11:37:22Z","intervals":[{"start_time":1620,"end_time":2700},{"start_time":3060,"end_time":4140},{"start_time":4500,"end_time":5580},{"start_time":5940,"end_time":7020},{"start_time":7380,"end_time":8460}]},{"id":26294188481165,"name":"Live Chat - Acuity CUSU HVCS (COSO-4219)","time_zone":"Eastern Time (US & Canada)","created_at":"2024-04-29T14:59:37Z","updated_at":"2025-02-13T14:33:59Z","intervals":[{"start_time":1680,"end_time":2640},{"start_time":3120,"end_time":4080},{"start_time":4560,"end_time":5520},{"start_time":6000,"end_time":6330},{"start_time":7440,"end_time":8400}]},{"id":28799929362829,"name":"Live Chat - Acuity","time_zone":"Eastern Time (US & Canada)","created_at":"2024-07-29T17:52:26Z","updated_at":"2025-02-13T14:34:09Z","intervals":[{"start_time":1680,"end_time":2640},{"start_time":3120,"end_time":4080},{"start_time":4560,"end_time":5520},{"start_time":6000,"end_time":6330},{"start_time":7440,"end_time":8400}]},{"id":30299777743117,"name":"New schedule","time_zone":"Paris","created_at":"2024-09-16T17:00:21Z","updated_at":"2024-09-16T17:16:32Z","intervals":[{"start_time":2040,"end_time":2400},{"start_time":3480,"end_time":3840},{"start_time":4920,"end_time":5280},{"start_time":6360,"end_time":6720},{"start_time":7800,"end_time":8160}]}],"url":"https://squarespace.zendesk.com/api/v2/business_hours/schedules"}

Squarespace Payments

Squarespace Payments Product Area

Getting started with Squarespace Payments

Managing payments and payouts with Squarespace Payments

Understanding a negative balance with Squarespace Payments

Managing your Squarespace Payments account

Accepting Payments

Learn how to process transactions when selling your products on Squarespace

Payment Completed

An error occurred while processing your action. Please try again.

Message not delivered. Click to retry.

An error occurred while processing the card.

Please try again or use a different card.

Form not submitted. Click anywhere on the form to retry.

Sync your conversation and continue messaging us through your favorite app.

Be notified when you get a reply.

My conversations

1 minute ago

Just now

{value} minutes ago

1 hour ago

{value} hours ago

Yesterday

MM/DD/YY

{user} sent a message

Someone

{user} sent a file

{user} sent a form

{user} sent an image

{user} filled a form

{user} sent a location request

You

MMMM D YYYY, h:mm A

Reconnecting...

You're back online!

Offline. You will not receive messages.

Couldn’t load conversations.

Change my email

To be notified by email when you get a reply, enter your email address.

Email

Your email address

Please submit a valid email address.

Submit

Load more

Retrieving history...

Max file size limit exceeded ({size})

This entry is required

Unsupported file type.

Email is invalid

Must contain at least ({characters}) characters

Must contain no more than ({characters}) characters

Choose one...

This doesn't look quite right

To talk to us using email just send a message to our email address and we'll reply shortly:

How can we help?

Click to reload image.

Click to view {size} image.

Type a message...

Preview not available.

Message us below or from your favorite app.

Press Enter for each item

An error occurred when attempting to generate a link for this channel. Please try again.

To talk to us using LINE, scan this QR code using the LINE app and send us a message.

Sync your conversation

Your browser does not support location services or it’s been disabled. Please type your location instead.

This website cannot access your location. Please type your location instead.

Could not send location

This website cannot access your location. Allow access in your settings or type your location instead.

An error occured while sending your message. Please try again.

({count}) New messages

{value}d ago

({count}) New message

Just now

{value}m ago

{value}h ago

Delivered

h:mm A

Seen

Max message size limit exceeded ({size}).

Sending...

Sync this conversation by connecting to your favorite messaging app to continue the conversation your way.

Connect your Facebook Messenger account to be notified when you get a reply and continue the conversation on Facebook Messenger.

New Conversation

Other Channels

Connected

Hi there 👋\nTo start off, we'd like to know a little bit more about you:

Connected as {username}

Your name

Email

Type your name...

Thanks for that! What can we help you with?

name@company.com

Send

You'll be notified here and by email at {email} once we reply.

Settings

Location

Cancel

We were unable to communicate with this number. Try again or use a different one.

Connect your SMS number to be notified when you get a reply and continue the conversation over SMS.

Change my number

Check your messages at {number} to confirm your phone number.

Please submit a valid phone number.

Send

Link to {appUserNumber} was cancelled.

Pending

Start Texting

There was an error sending a message to your number.

Send me a text

A connection for that number was requested recently. Please try again in 1 minute.

A connection for that number was requested recently. Please try again in {minutes} minutes.

Sync conversation

Something went wrong. Please try again.

Message not delivered. Tap to retry.

Form not submitted. Tap anywhere on the form to retry.

Connect your Telegram account to be notified when you get a reply and continue the conversation on Telegram

Unsupported message type.

Unsupported action type.

File

Invalid file.

Image

A virus was detected in your file and it has been rejected

Connect your Viber account to be notified when you get a reply and continue the conversation on Viber. To get started, scan the QR code using the Viber app.

Connect your Viber account to be notified when you get a reply and continue the conversation on Viber. To get started, install the Viber app and tap Connect.

An error occurred while fetching your Viber QR code. Please try again.

Connect your WeChat account to be notified when you get a reply and continue the conversation on WeChat. To get started, scan this QR code using the WeChat app.

An error occurred while fetching your WeChat QR code. Please try again.

Connect your WeChat account to be notified when you get a reply and continue the conversation on WeChat. To get started, save this QR code image and upload it

QR code scanner.

Sync your account to WhatsApp by scanning the QR code or clicking the link below.\nThen, send the pre-populated message to validate the sync request. (Your code: {{code}}).

Sync your account to WhatsApp by clicking the link below.\nThen, send the pre-populated message to validate the sync request. (Your code: {{code}}).

An error occurred while fetching your WhatsApp linking information. Please try again.

Chat wait times are longer right now due to a high volume of requests. The fastest way to connect to a member of our Support team is to stay in this chat.

You don't have to wait in the chat queue to get a response. I’ll send your transcript to our team. We'll respond via email as soon as we can.

You'll be leaving the live chat queue and losing your place in line. You can re-enter the queue at any time by starting a new live chat.

No mode found

Waiting for an agent...

Send an email instead?

Cancel chat request?

Cancel Chat

Send Email

Confirm

Send an email instead

Continue waiting

Squarespace Assistant

View Queue Status

Live chat support for this language is currently offline.

Chatbot not working?

Report it to our team.

Hi

let's get you the help you need.

Our automated Support Assistant will work with you to try to find a quick answer.

Want to talk to a human? The Support Assistant can connect you with a member of our team through live chat or email.

contact us

Ways to get help

Start with our automated Support Assistant

Get quick answers from our chatbot any time. Type your question and you'll get immediate guidance.

Email or chat with our support team

Need more help? Our Support Assistant will connect you to an Advisor on our Customer Support team.

Let's get you the help you need.

For faster support, please log in.

Live chat is not available.

Chat in English

Live Chat

Live chat is not available right now. Please send us an email and we'll respond within 12 hours.

Live chat is not available in your language right now. Chat with us in English, or send us an email and we'll respond within 12 hours.

Live chat is available in your language Monday-Friday, from 10:00 AM to 4:00 PM CET.

Live chat is not available in your language. Please send us an email and we'll respond within 12 hours.

Live chat is not available in your language. Chat with us in English, or send us an email and we'll respond within 12 hours.

Real-time conversations and immediate responses from our award-winning Customer Support Team. Monday-Friday: 10:00 AM to 4:00 PM CET

Live chat is not available right now. Please send us an email and we'll respond within 12 hours.

Live chat is available in your language Monday-Friday, from 10:00 AM to 4:00 PM CET.

Skip To Chat